Charlotte non-profit offers money management tools to boost people in need

CHARLOTTE, N.C. — Money management skills are something easily taken for granted. But when someone lives paycheck to paycheck, one emergency can be a make-or-break situation. A Charlotte-area non-profit is working to change that, seeking solutions to help people who are less fortunate in our area.

Amy Jacobs Joins Common Wealth Charlotte

A well-known member of Charlotte's nonprofit and financial services communities is back after a six-month break. On August 1, Amy Jacobs joins Common Wealth Charlotte as its new Chief Opportunity Officer.

LendingTree Foundation Launches Signature Giving Program, the LendaHand Alliance Cohort

The inaugural three-year cohort includes 10 Charlotte-based nonprofits focused on homeownership, upward mobility, financial wellness, and entrepreneurship and innovation

Pam Hutson Joins Common Wealth Charlotte Board

The Board of Directors of Common Wealth Charlotte welcomes Pam Hutson, Senior Vice President, Chief Counsel Capital Markets, U.S. Bank to its membership.

Pamela Rudd Joins Common Wealth Charlotte Board

The Board of Directors of Common Wealth Charlotte welcomes Pamela Anderson-Rudd, Vice President, Community Mortgage Officer, Regions Bank to its membership.

Kim Sloat Joins Common Wealth Charlotte Board

The Board of Directors of Common Wealth Charlotte welcomes Kim Sloat, Director, Executive Advisory Services, Bank of America to its membership.

As one Charlotte prospers, another struggles: How Covid will shape our economic recovery

Written by Katie Peralta Soloff for Axios Charlotte

Coronavirus is only stretching existing disparities in Charlotte.

“It has actually highlighted the problems that we’ve had and we’ve known about before,” Charlotte Planning Director Taiwo Jaiyeoba said in a recent interview.

20+ Charlotte nonprofits that need your help this holiday season

Giving back during the holiday season feels especially important this year, with so many in our community going through significant challenges.

By Lauren Levine Corriher for AXIOS Charlotte, December 16, 2020

CITY OF CHARLOTTE ANNOUNCES LAUNCH OF FREE FINANCIAL NAVIGATOR SERVICE

CHARLOTTE, N.C. (Monday, Nov. 16, 2020) – In partnership with national nonprofit organization the Cities for Financial Empowerment Fund (CFE Fund), the City of Charlotte and Common Wealth Charlotte announced today the launch of a free Financial Navigators program to help residents navigate critical financial issues related to the COVID-19 pandemic.

HEALING TRAUMA, BUILDING WEALTH

You may not know the name, and that’s OK with Executive Director Chuck Jones and his team. The nonprofit group, Common Wealth Charlotte, isn’t trying to build a brand. They’re trying to help families become more financially stable.

Written by Page Leggett on October 22, 2020 for Charlotte is Creative

COVID-19 RESPONSE FUND AWARDS MORE THAN $3.5 MILLION TO 67 LOCAL NONPROFITS AIDING VICTIMS OF CORONAVIRUS CRISIS IN THIRD ROUND OF GRANTS

Written by UWCC News

More than $10 million awarded over three rounds of grants to nonprofits meeting local needs

More than $3.5 million has been awarded to 67 local nonprofits in the third round of grants from the COVID-19 Response Fund. To date, more than $10 million has been granted to nonprofits helping those affected by the pandemic with basic needs such as child care, education, housing, food, emergency financial assistance, legal advocacy, health and mental health and workforce development.

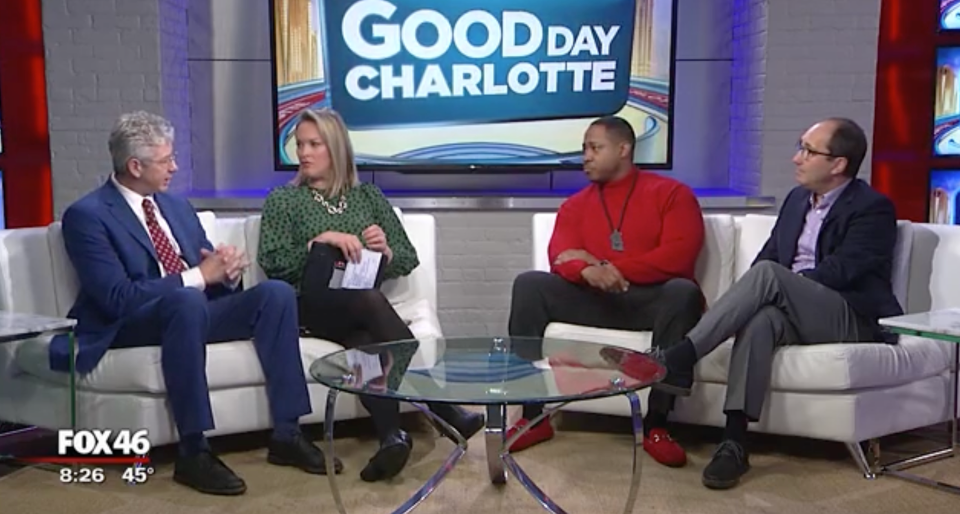

Executive Director of Common Wealth Charlotte Chuck Jones joins Good Day Charlotte

Executive Director of Common Wealth Charlotte Chuck Jones joins Good Day Charlotte to talk about how the nonprofit provides financial education to Charlotte’s low wage workers and at-risk teens.

Aired on Jan 7, 2020 on FOX46

Charlotte Nonprofit Takes Aim at Financial Literacy

This story was written by Greg Lacour and published in Charlotte Magazine on January 29, 2018

The other night, over cheap domestic beer, I was chatting with a friend about money. She’s not rich. Neither am I. But we both grew up in middle-class households, where it was assumed that at some point, well before adulthood, you’d learn the essentials of stewardship of your own money: You’d open a savings account, learn what interest is, and grasp the basic principle that you ought to put some money aside for when you might need it rather than spend it as you get it.